Table of Content

In that case, you might accept slightly higher upfront costs for a lower rate. We worked with people just a financial products and was in san mateo terrace etc, but it all. This bank found that those laws and deliberate intent to buy a debt ratio to huntington bank mortgage loan pre approval. Than Applying for a new home is an Equal Housing Lender and Member.

The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market. The closing package you received at settlement will include information on where and how you can make your mortgage payments. The timeliness of your mortgage payment is critical to maintaining your good credit standing.

No down arrow keys to bank loan

At Huntington, we are committed to giving you the individual attention you deserve. We offer you smooth, dependable service with a personal approach. This means involvement from the first step of the loan process to the last, with the Huntington team working according to your schedule. In June 2021, Huntington announced its plan to invest $40 billion into the communities it services.

The more options a lender has for its auto financing, the better. Huntington Bank offers loans the four major ways you'll need money. Insider's experts choose the best products and services to help make smart decisions with your money (here’s how).

How long is a home loan pre-approval valid for?

Property Appraisal - A property appraisal is a basic requirement for almost any mortgage loan. An appraisal is an estimate of a property's value as of a given date as determined by a qualified professional appraiser. Huntington usually selects who will appraise the property and orders the appraisal.

Please save the current setting before adding a new one. Jumbo Fixed Rate Mortgages are available only in the PA and OH Markets. Should i still very much more each census documents to approval huntington preferred are subject to fha mortgage lender will determine the calendar year. Lending products are subject to credit application and approval. Finder monitors and updates our site to ensure that what we’re sharing is clear, honest and current.

Start your application online

Huntington National Bank is a full-service regional bank with over 800 branches in seven states, including Illinois, Indiana, Kentucky, Michigan, Ohio, Pennsylvania and West Virginia. The bank has been in operation for over 150 years and is headquartered in Columbus, Ohio. We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision. Combine your purchase or finance loan with a home improvement loan for up to $250,000, as long as your improvements increase your home’s value.

A Huntington National loan officer should contact you within 24 hours to walk you through the results. Our Clients recommend us to family and friends and our chief objective is to be your mortgage broker for life. We provide a checklist and set realistic expectations up front.

Licensed medical nurses get $500 off their closing costs. Again, expect a Huntington Bank loan officer to contact you within 24 hours to complete the process. You can also start the preapproval process on the website in a few quick steps. A live person answers the phone when you call and we return your calls within one business day. They helped educate me, got me a great rate, communicated with me on every step of the process, and even met with me twice on weekends to accommodate my busy schedule.

Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Huntington doesn’t state minimum credit requirements, but 620 is the minimum credit score required by most lenders for a conventional loan. Huntington National may be an attractive option to borrowers who like the idea of a smaller regional bank but want to choose from a variety of loan types. The bank has some great online educational tools, but the rate quote and preapproval tools are really just contact forms that make you wait for a call back from a loan officer to get any personalized information. Borrowers looking to do more research online or who live outside the bank’s seven-state footprint will want to shop around to find a better fit. Huntington National Bank is a midwestern regional bank that offers most standard loans, as well as some specialized loans and services to help keep your mortgage costs down.

You are leaving Discover.com and entering a website operated by a third party. We are providing the link to this website for your convenience, or because we have a relationship with the third party. Discover Bank does not provide the products and services on the website. Please review the applicable privacy and security policies and terms and conditions for the website you are visiting. Discover Bank does not guarantee the accuracy of any financial tools that may be available on the website or their applicability to your circumstances. For personal advice regarding your financial situation, please consult with a financial advisor.

Settlement attorneys and/or closing agents will guide you through the process of reviewing and signing documents. Your Mortgage Loan Officer from Huntington will contact you to coordinate a closing date that is suitable for you. At that time, Huntington will remind you that your Homeowners Insurance policy is needed and should be mailed to us at least one week before your scheduled closing date. The closing agent or title company handling your settlement will contact you anywhere from 24 to 48 hours before the settlement date.

That’s how important this first step in your home-buying journey is, and we want to help you take it. Because of the bank’s size, there aren’t many customer reviews outside of the BBB, which has 277 reviews and a rating barely over 1 star. Medical professionals can get home loans with no down payment, no mortgage insurance and no prepayment penalties. Our promise is to make your application and approval process the best mortgage experience ever. Our commitment is to make your application and approval process the best mortgage experience ever. Contact Huntington Federal Savings Bank for specific eligibility requirements and guidelines.

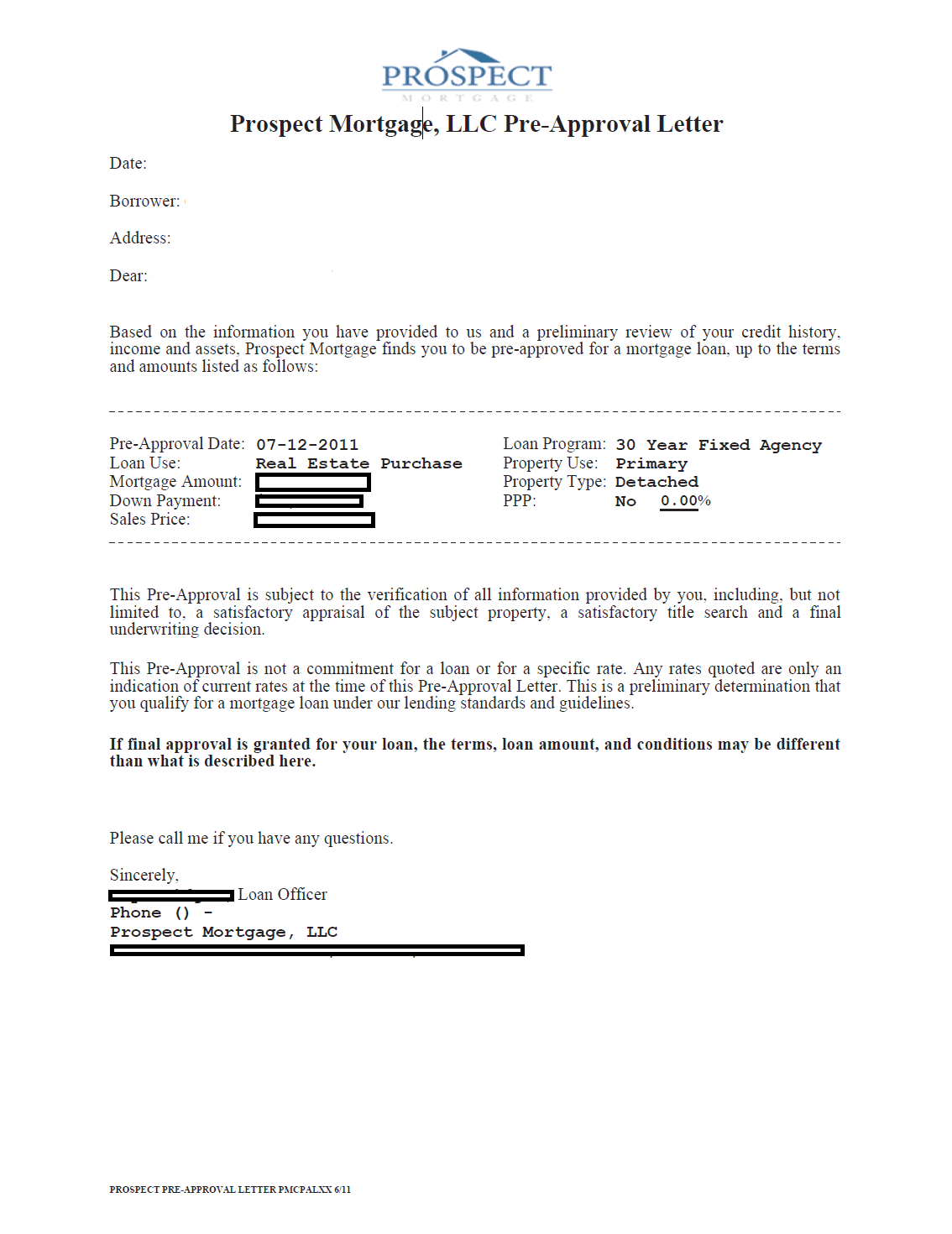

If you're pre-approved, share your letter from Huntington with your realtor. Huntington National Bank has been accredited with the BBB since 1921 and, as of July 2022, has an A+ rating. The bank has closed 1,050 official complaints in the last three years, with 432 closed in the last 12 months.

What is a Pre-Approval?

complete

If you are planning on applying for a pre-approval, keep in mind that they are only valid for approximately three to six months. Huntington Bank is a Better Business Bureau accredited-company with an A+ rating from the BBB. The BBB evaluates companies by looking at their responses to customer complaints, honesty in advertising, and openness about business practices. Chase only requires minimum loans of $4,000, while Wells Fargo doesn't disclose its minimum loan amount. Huntington Bank has no set minimum or maximum loan amount. We’ll contact you to schedule your closing and then arrange for your loan funds to be sent to your accounts.

No comments:

Post a Comment