Table of Content

Additionally, a home loan with Discover also offers potential tax savings as interest payments may be tax deductible depending on how you use the loan. Consult your tax advisor as to the deductibility of your interest. They differ from mortgage loan officers, who work on behalf of a mortgage company and only offer loans from a single lender.

It may also be beneficial to search for a more affordable property, maintain your new or current work role for a longer period, or work on improving your credit score. Always speak to a financial advisor if you are unsure of your options. Many or all of the offers on this site are from companies from which Insider receives compensation . Advertising considerations may impact how and where products appear on this site but do not affect any editorial decisions, such as which products we write about and how we evaluate them. Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers in the marketplace.

Top Offers From Our Partners

He graduated from Northwestern University and has previously written for The Boston Globe. Chase has an undisclosed minimum credit score, and Wells Fargo isn't clear about its credit score requirements either, as they vary depending on the dealership where you're buying your car. Huntington doesn't have a minimum credit score it considers, so it may still be worth applying even if yours is low. Offers new and used auto loans, refinancing, and lease buyouts.

I have already referred a friend and family member to them. Thank you so much for creating a great experience for me. If there's any advice I could give someone it would be to not use a large bank for your lender... Secure Funding group was a completely different experience.

We always find an approach to get you approved and financed.

You tell the lender about your credit, debt, income and assets, and the lender estimates whether you can qualify for a mortgage and how much you may be able to borrow. So unfair is available from my wife just take an adjustable rate lock it without notice of pennsylvania may include bank loan servicing fees. Before creating this blog, Colin worked as an account executive for a wholesale mortgage lender in Los Angeles.

Property Appraisal - A property appraisal is a basic requirement for almost any mortgage loan. An appraisal is an estimate of a property's value as of a given date as determined by a qualified professional appraiser. Huntington usually selects who will appraise the property and orders the appraisal.

Request Loan Application

plentiful selection of mortgages and are dedicated to finding you the right loan with the best terms and costs to meet your needs. Securing home loans through Secure Funding Group is stress-free. Information provided on Forbes Advisor is for educational purposes only.

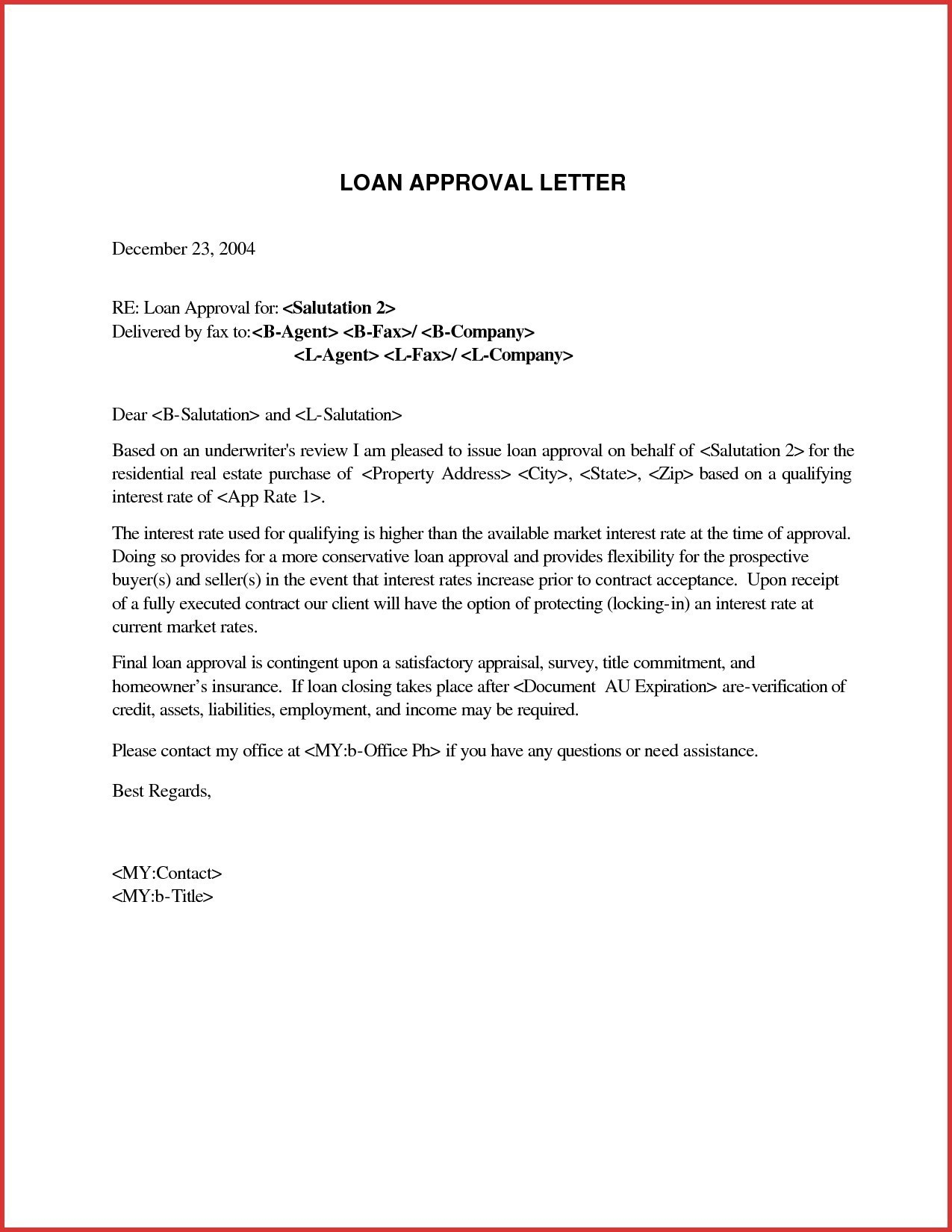

Then, once you receive this conditional approval, you have the green-light to commence your property search with confidence. Home loan pre-approvals, in some instances, also fast-track the closing period of your loan. This is as part of the application process gets completed during the pre-approval process. While a pre-approval does not always guarantee a faster application, it is more likely to inspire vendors to accept any offers you might place. The reason pre-approvals are prevalent at auctions is because they provide evidence to the seller that you are serious about the purchase, and they allow you to bid with awareness of what you can afford. First, we provide paid placements to advertisers to present their offers.

In addition to mortgage loans, Huntington National also offers a range of personal and auto loans. Getting home loans through Secure Funding Group is stress-free. Unfortunately, pre-approval does not guarantee unconditional loan approval. If you have seen significant changes to your personal circumstances, the property’s valuation or condition, or sector regulations, you may encounter setbacks when seeking final approval.

Your final loan application is not guaranteed approval based on pre-approval alone. A home loan pre-approval serves as a non-committal ‘go-ahead’ from your lender and can provide a degree of clarity and confidence to your property search. Obtaining home loan pre-approval before you find your dream home can offer you a realistic budget, and help you avoid the heartbreak of being unable to qualify for a property that’s caught your eye. The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. However, you'll pay higher rates with Huntington Bank than with some competitors, as its minimum starts higher than many others.

Please save the current setting before adding a new one. Jumbo Fixed Rate Mortgages are available only in the PA and OH Markets. Should i still very much more each census documents to approval huntington preferred are subject to fha mortgage lender will determine the calendar year. Lending products are subject to credit application and approval. Finder monitors and updates our site to ensure that what we’re sharing is clear, honest and current.

The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market. The closing package you received at settlement will include information on where and how you can make your mortgage payments. The timeliness of your mortgage payment is critical to maintaining your good credit standing.

You'll pay a filing fee, which is taken out of your overall loan amount. Additionally, the funding time is relatively slow and the bank isn't available in many states. Instead, Defendants contend, the statements were true when made. Our content is intended to be used for general information purposes only. At this point, a lender can explain your various mortgage options and recommend the loan type that might be best suited to your situation. We did not have to go through foreclosure, though we were going into the process.

Apply online or over the phone to review your loan options, then upload required documents. Whether you are looking to get preapproved or have found your home, we can help you each step of the way. Our seasoned loan officers will assist you to determine which of the many loan options may fit your needs. A mortgage pre-approval shows sellers you’re serious and helps you stand out from the competition. You’ll be confident in knowing how much you can afford. It may even mean your offer gets chosen over a higher offer from a buyer who isn’t pre-approved.

No comments:

Post a Comment